The Debt to GDP Death Spiral

The Simple Truth Hidden in Plain Sight

Picture this: Farmer Alice has 100 apples and Merchant Bob has 10 hammers. In their small economy, they’ve established that 1 hammer equals 10 apples—a fair trade based on relative scarcity and utility.

Now imagine a crisis hits Bob’s hammer supply chain. He can only produce 2 hammers this season, while Alice’s apple harvest explodes to 200 apples due to perfect weather. Suddenly, the exchange ratio shifts dramatically: 1 hammer now commands 100 apples. Alice, desperate for tools, must give up nearly half her harvest for a single hammer.

This is exactly what’s happening to the U.S. dollar—except we’re Alice, drowning in an oversupply of currency.

The Numbers Don’t Lie: We’re In Uncharted Territory

According to Lawrence Lepard’s analysis in “The Big Print,” America’s debt-to-GDP situation has reached truly treacherous levels. The data reveals a stark reality:

- U.S. Federal Debt: Exploded from under $1 trillion in 1980 to over $35 trillion today

- Debt-to-GDP Ratio: Now exceeding 130%—a threshold historically associated with sovereign debt crises

- Interest Payments: Consuming an ever-growing portion of federal revenue

As Lepard documents, “The U.S. added $11 trillion in debt since 2020,” while it “took 220 years for total U.S. debt to reach $11 trillion.” We’re witnessing exponential debt growth that has completely detached from economic reality.

The Weimar Warning: When Currencies Collapse

Germany’s Weimar Republic offers the most chilling historical parallel. Following World War I, Germany faced:

- Crushing war reparations that exceeded the country’s ability to pay

- A government that chose printing money over fiscal responsibility

- Hyperinflation that destroyed the middle class and paved the way for extremism

Lepard’s research shows how quickly things unraveled: “By 1923, it took 1 trillion German marks to buy what 1 mark purchased in 1918.” The currency became literally worthless—people used wheelbarrows to carry enough cash for basic purchases.

The parallel is unmistakable: when governments print money to finance unsustainable spending, the currency becomes the hammer in our farmer’s dilemma—increasingly scarce in purchasing power while growing abundant in nominal terms.

Recent Catastrophes: Argentina and Venezuela

We don’t need to look back a century for examples. Argentina and Venezuela provide fresh warnings:

Argentina’s Recurring Crises:

- Multiple currency collapses and sovereign defaults

- Inflation rates exceeding 100% annually

- Citizens fleeing to U.S. dollars for preservation of wealth

Venezuela’s Tragic Descent:

- Hyperinflation reaching over 1,000,000% at its peak

- Mass emigration as the economy collapsed

- A reminder that oil wealth means nothing if monetary policy is reckless

Both nations followed the same playbook: excessive government spending financed by money printing, leading to currency debasement and economic collapse.

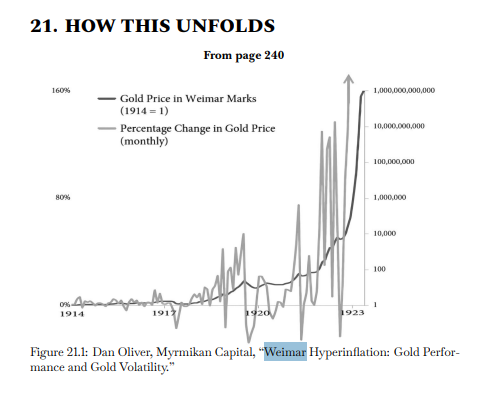

The Weimar Chart That Should Terrify Every American

The most sobering visual evidence comes from Dan Oliver’s analysis of Weimar Germany’s hyperinflation. The chart below shows gold’s price in German marks from 1914 to 1923—a horrifying exponential curve that reveals how quickly currency collapse accelerates:

Notice the terrifying pattern: years of relative stability, followed by exponential collapse. From 1914 to 1920, gold’s price in marks rose modestly. Then came the parabolic phase—by 1923, gold cost over 1 billion times more in German marks than it had in 1914.

This wasn’t gradual inflation. This was currency annihilation.

The Gold Standard: Why Historical Context Matters

Here’s where our barter analogy becomes crucial. For most of human history, gold served as the “hammer” in our farmer’s tale—scarce, durable, and universally valued. Countries tied their currencies to gold, creating natural constraints on money printing.

As Lepard notes, from 1800 to 1971, America operated under various forms of gold-backed money. During this period:

- Prices remained relatively stable over decades

- Economic growth was robust without monetary manipulation

- Currencies maintained purchasing power across generations

The 1971 Nixon Shock ended gold convertibility, unleashing the era of pure fiat currency. Since then, every major currency has lost significant purchasing power against real assets—exactly like Alice’s apples flooding the market.

Currency as Commodity: The Ultimate Reality

This brings us to the fundamental truth most people miss: currency is just another commodity. When governments increase the supply dramatically (like Alice’s bumper apple crop), each unit becomes worth less in real terms.

The U.S. dollar benefits from reserve currency status—the world’s economic “habit” of using dollars for trade and savings. But habits can change, especially when:

- Money supply grows exponentially (as it has since 2008)

- Debt becomes mathematically unpayable (as we’re approaching)

- Alternative stores of value emerge (like Bitcoin and gold)

The Math of Monetary Collapse

Lepard’s analysis reveals the mathematical impossibility of our current path:

- Federal spending continues growing faster than the economy

- Interest payments compound on an ever-growing debt base

- Demographics worsen the fiscal picture as baby boomers retire

When debt service costs exceed the government’s ability to pay through taxation, only two options remain: default or debasement. History shows governments almost always choose debasement—printing money to pay debts in cheaper currency.

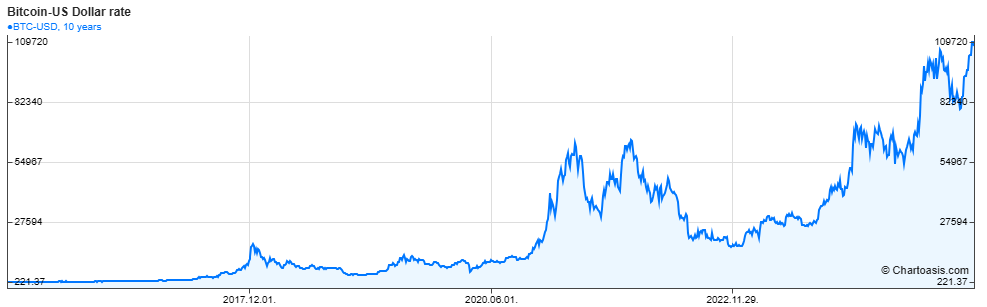

The Modern Parallel: Dollars Priced in Bitcoin

Fast-forward to today, and we’re witnessing a similar pattern with the U.S. dollar versus Bitcoin. The chart below shows Bitcoin’s price in U.S. dollars over the past decade—revealing the dollar’s relentless debasement against this digital store of value:

This chart tells the same story as the Weimar gold chart, just inverted. While the German mark chart showed gold’s price exploding upward (currency collapsing), this Bitcoin chart shows the same dynamic: one Bitcoin that cost under $1,000 in early years now trades above $100,000.

This isn’t just a “tech stock going up.” This is what it looks like when a new form of sound money emerges alongside a debasing currency. Just as gold maintained its purchasing power while the German mark collapsed, Bitcoin has preserved and increased wealth while the dollar has been systematically debased.

The pattern is identical to Weimar, just playing out over a longer timeframe—and we’re still in the early phases.

The Hammer Becomes Scarce: What Happens Next

Returning to our farmer’s dilemma: what happens when people realize Alice’s apples (dollars) are becoming worthless while Bob’s hammers (real assets) are increasingly precious?

Smart farmers stop accepting apples. They demand:

- Gold and silver (traditional stores of value)

- Bitcoin (digital scarcity)

- Real estate and commodities (tangible assets)

- Foreign currencies backed by sounder fiscal policies

The Gresham’s Law Acceleration

Economist Thomas Gresham observed that “bad money drives out good”—people hoard valuable currency while spending debased currency first. We’re seeing this globally as:

- Central banks accumulate gold at record rates

- Developing nations reduce dollar reserves

- Individuals flee to Bitcoin and precious metals

- Corporations buy real assets instead of holding cash

Preparing for the Reset

The mathematical certainty of our debt trajectory means change is coming. Those who understand currency as commodity will position accordingly:

- Reduce exposure to dollar-denominated assets that government can inflate away

- Increase holdings of scarce, real assets that maintain purchasing power

- Understand the historical precedents that show how these crises unfold

- Prepare for potential social and political upheaval that accompanies monetary collapse

Conclusion: The Farmer’s Choice

In our barter economy, Alice has a choice: continue flooding the market with apples (dollars) while their value plummets, or recognize the new reality and adjust accordingly.

America faces the same choice. We can continue pretending debt doesn’t matter, that money printing has no consequences, and that reserve currency status grants immunity from economic laws.

Or we can acknowledge what history teaches: currencies that lose their scarcity become worthless, governments that spend beyond their means face reckoning, and those who recognize these patterns early can protect themselves.

The math is clear. The historical precedents are undeniable. The question isn’t whether change is coming—it’s whether you’ll be prepared when Alice’s apples become worthless and Bob’s hammers become priceless.